The Federal budget was announced on Tuesday 6th October after a delay due to the coronavirus pandemic.

Treasurer Josh Frydenberg said it would focus heavily on job creation in order to pull the country out of the economic crisis it faces. With uncertainty remaining until a vaccine for Covid-19 is available, there will likely be more announcements as circumstances change over time.

Some of the key measures in the budget are:

Tax cuts

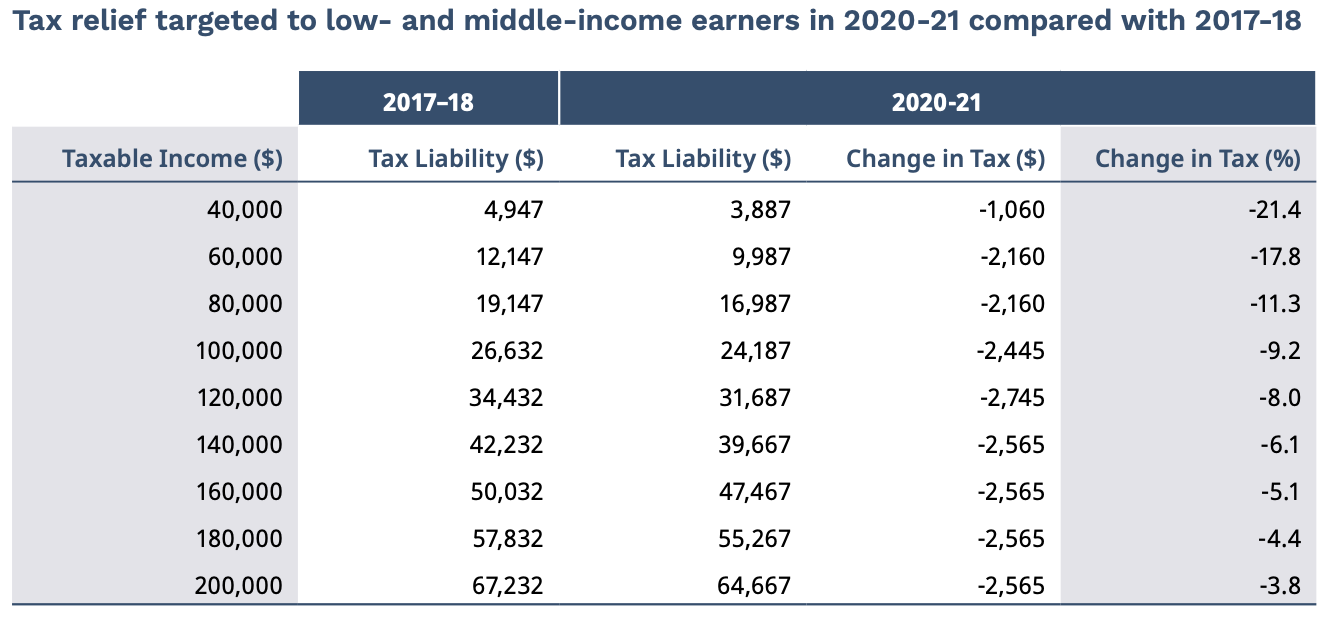

Lower and middle income earners will receive a tax cut that will be up to $2,745 for singles or up to $5,490 for dual income families in 2020–21.

The table above is taken from the Government’s Budget website – talk to us about actual figures for your situation.

Businesses

Employers and young workers – The JobMaker hiring credit is aimed at increasing employment for young people aged 16-35 years. Employers who demonstrate an increase in overall employment will receive a credit for a period of 12 months for eligible employees.

The instant asset write-off threshold – Businesses with turnover up to $5 billion will be able to write off the full cost of eligible depreciable assets of any value in the year they are first used or installed ready for use. The cost of improvements made during this period to existing eligible depreciable assets can also be fully deducted.

Temporary loss carry-back – Companies with turnover up to $5 billion will be able to temporarily, up to June 2022, offset tax losses against previous profits and tax paid in or after 2018-19.

Research and Development – For small claimants (turnover less than $20 million), the Government will increase the refundable R&D tax offset to 18.5 percentage points above the claimant’s company tax rate.

Fringe Benefit Tax Returns now simpler – employers will be able to use existing corporate records, rather than prescribed records, to complete their FBT return and employer-provided retraining activities will now be exempt when employees are redeployed to a different role in or outside the business. From April 2021, carparks and electronic devices will also see concessions.

Paid parental leave is extended – Parents will now qualify for the payment if they have worked 10 of the 20 months before giving birth or adopting, as opposed to 10 of the past 13 months.

Tourism

$50 million will go to a Regional Tourism Recovery initiative to support tourism operators market to a domestic audience.

Farming

The budget promises $2 billion for concessional loans to help Farmers receiver from drought. There are also plans for improved water infrastructure and support for exporters.

Infrastructure

Over the next four years an additional 14 billion is committed for new and accelerated projects in Australia.

Apprenticeships and training

Businesses will receive the 50 per cent wage subsidy, up to a cap of $7,000 per quarter, for commencing apprentices and trainees, including those employed by Group Training Organisations, until 30 September 2021$252 million will be spent over two years to support the delivery of 50,000 higher education short courses in areas including teaching, health, information technology, science and agriculture.

Super

Superannuation funds will now be linked to employees and move with them in order to stop so the creation of unintended multiple accounts. An online tool named YourSuper will give people the ability to compare funds. Aged care pensions will increase by an extra $250 payment in December and March, and government funding will be provided for 23,000 new home care packages.

There are also commitments across a number of other areas such as for the homeless, investment in dementia care, health, tourism, first home buyers and the environment.

Recent Comments